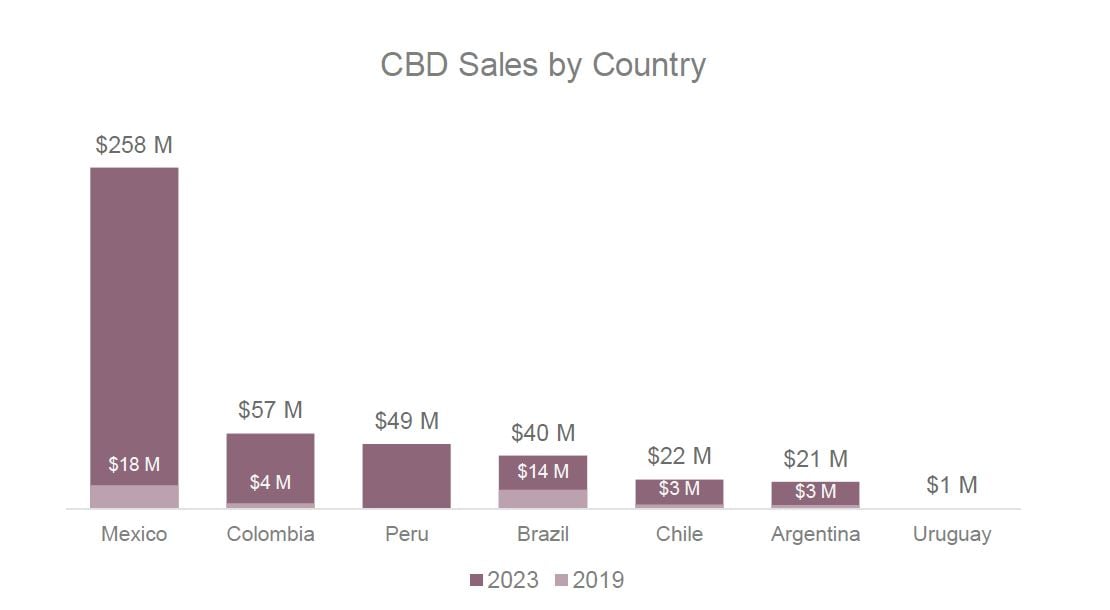

Some countries have legalized cannabis for medical use including Chile, Mexico, Colombia, Brazil, Argentina, and Peru, but this market will fail to scale in any meaningful way due to the region's complicated history with drug trafficking, noted Brightfield Group in its report.

"The near-term opportunities for CBD in Latin America are more promising than for marijuana, as the continent struggles to shake the stigma and negative legacy of the war on drugs and powerful drug cartels," said Brightfield.

"CBD products provide a welcome alternative for countries with a high level of stigma towards marijuana and the importation of non-psychoactive oils avoid a competition with or diversion to the black market."

Colombia and Mexico already have legal commercialization frameworks in place.

Colombia and the CBD market

In Colombia, CBD products -- including supplements, oils, tinctures, sprays, capsules, and topicals -- are legal through retailers licensed by INVIMA (Colombia's food and drug regulatory agency) provided they contain <1% THC by dry weight content.

According to Brightfield, the CBD market has strong potential in Colombia where the citizens have become more aware of CBD's purported health benefits from recent media attention surrounding medical patients' fight for access to CBD oil.

However, high costs -- which range from US$10-30 per product -- limit appeal and accessibility to high-income groups that account for roughly 12% of the Colombia population, noted Brightfield.

On the other hand, Colombia has the advantage of local production, which eliminates additional import fees and costs, which drive CBD prices in other countries in the region," said Brightfield.

"As the domestic cultivation industry grows alongside retail sales of CBD products, we expect marketing trends to promote the country’s prime growing conditions and drive further interest in CBD."

These factors have made Colombia an attractive investment for international companies involved in the cultivation and farming of the cannabis plant, added Brightfield.

Mexico

In Mexico, the Federal Commission for the Protection Against Sanitary Risk (COFEPRIS) granted several commercialization licenses for CBD products with less than 1% THC content in 2018 including oils, dietary supplements and cosmetic products. By the end of 2019 or early 2020, several retailers are expected to begin selling CBD products most likely testing the waters with capsules and topicals, according to Brightfield.

The US advantage

Because CBD is no longer a Schedule Substance in the US like it is in Canada, Brightfield believes US-based CBD companies will enjoy an advantage when it comes to imports to Latin America.

Some emerging CBD players from the US include that have entered the Latin America market include:

- Bluebird Botanicals (Brazil)

- Mary's Nutritionals (Brazil)

- Green Roads (Chile)

CBD Life will be one of the first companies to legally import CBD products to Mexico, having gained import approval for Foria's CBD Arousal Spray, Awaken M, in August 2019.

"It is likely that other US-based CBD companies will come to distribution agreements with companies in Mexico, bringing a wider range of brands and product types to the Mexican consumer," Brightfield stated.

Brazil presents 'huge' market potential

While Brazil has only legalized CBD for medical use by patients with a doctor's approval, its use is expecting to eventually trickle down to a broader retail market.

"The market potential for CBD products in Brazil is huge," said Brightfield who predicts that the region's most populous country will eventually allow CBD as a supplement ingredient if the Brazilian Health Regulatory Agency (ANVISA) approves the cultivation and production of medical marijuana.

"As the domestic cultivation industry grows alongside retail sales of CBD products, we expect marketing trends to promote the country’s prime growing conditions and drive further interest in CBD."

Home-grow market

The market for CBD products will continue to grow in Latin America especially in countries that have received outside company investment and regulatory approval to grow and cultivate cannabis on a commercial sale.

However, high price point still stand in the way for many Latin American consumers, which has led to the rist of a home-grow market in many countries.

Mexico, Colombia, Chile, Uruguay, and Brazil already allow home-growing for personal consumption within certain parameters, either for recreational or medical purposes.

"This creates more opportunities for grow shops and companies offering home grow supplies than actual dispensaries, cultivators, or infused product manufacturers. Several policy and trade associations in the region support the right to home grow as another way for patients to access the medicinal and healing effects of CBD," noted Brightfield.