GOED: Infant formula the 'shining star' for omega-3s in South America

Over a two-year period between January 1, 2016 and December 31, 2017, volume demand for omega-3s for infant formula grew 13.7% in South America [Brazil, Argentina, Chile and Peru] and 13.3% in Mexico, according to GOED's latest annual Global EPA and DHA Omega-3 Ingredient Market Report*. While dietary supplements remained the largest final product category for omega-3s in both markets, in volume and value terms, demand in volumes grew less over the review period – 6% for South America and 6.8% for Mexico.

*GOED divides Latin America into three categories for its annual review: Mexico as a standalone market due to its size; South America as a blend of four key markets – Brazil, Argentina, Chile and Peru; and Central America and the Caribbean within 'rest of world' due to minimal activity.

The rise of infant formula

Chris Gearheart, director of member communications and engagement at GOED, said infant formula was certainly a fast-evolving category for omega-3s in South America and Mexico.

“Especially for South America, infant formula is definitely the shining star in terms of demand,” Gearheart told NutraIngredients-LATAM.

During the review period, $1.7m worth of omega-3 ingredients went into infant formula in South America, he said, up 6.2% on the previous year. This was “more than twice as high” as the rise in omega-3s for dietary supplement, he said.

In Mexico, demand for infant formula omega-3s was also strong, up 3.1% in value terms at $3.3m. However, a look at volumes revealed clinical nutrition as“close at its heels”, with a 12% volume increase over the review period versus 13.3% for infant formula.

Asked what might be driving demand for omega-3s in infant formula across South America and Mexico, Gearheart said: “Likely for the same reason as in the emerging markets in Asia. As economies develop, incomes rise, and more women enter the workforce, we tend to see an increased demand for infant formula.”

Demand in the US, for example, was comparatively “kind of flat”, he said, with volumes of infant formula omega-3s up just 1.4% on the previous year.

Preference for common refined, potential for algal?

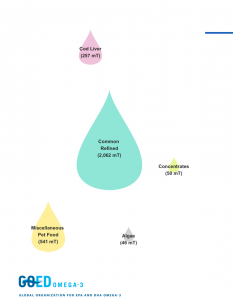

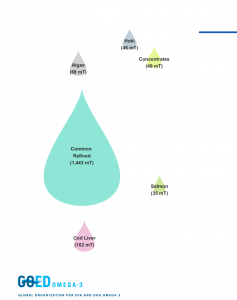

Gearheart said in Mexico and South America, common refined omega-3s made up the majority of volumes, followed by 'miscellaneous' ingredients for pet food and then cod liver oil.

Across South America, of the total 2,956 metric tons of omega-3 demand over the review period, 2,062 was common refined and 257 mT cod liver oil. In Mexico, a total of 1,743 mT omega-3 demand was 1,443 common refined and 102 cod liver oil.

Concentrates – favored in the US, Europe and China – represented much lower levels; just 50 mT in South America and 49 mT in Mexico.

However, the GOED report showed common refined was not the fastest-growing omega-3 source in volume terms for either region. In South America, concentrates saw the biggest volume gains, up 11.4%; followed by algae, up 9.8%. And in Mexico, hoki volumes were up 10.2%; with algae just behind at 9.1%.

Did algal omega-3s therefore hold promise in South America and Mexico? “It's still far behind the demand for common refined oil,” said Gearheart. “And that may have to do with the premium attached to buying algae supplements or products. But yes, there's an increase. ...It's still very small volumes, but demand is increasing.”

The rise, he said, could be being fueled by increased demands in infant formula, given some manufacturers preferred to use algal omega-3 because of DHA levels.

Challenges ahead? No daily recommended intakes...

Gearheart said there were clear opportunities for omega-3 ingredients in both South America and Mexico, given widespread growth of finished product categories incorporating omega-3s, but there also remained challenges.

“We don't see any daily recommended intakes for EPA and DHA in the top Latin American markets. There are several recommendations from Brazilian medical and nutritional organizations, but nothing governmental. Official government recommendations would likely help boost intakes in the region.”

Also, consumers in the two largest markets – Mexico and Brazil – relied on information from healthcare practitioners when considering the purchase of health and wellness products, rather than product labels, the internet or friends and family, he said. This insight from GOED's consumer research in the region suggested EPA/DHA consumption could be bolstered through increased doctor recommendations, he said.

“Our consumer research in Brazil suggests that the most common reason for starting to take omega-3s there is to support overall wellness (49.2%). Nearly a third of consumers surveyed also mentioned heart health, cholesterol, and brain health as motivating factors. There may be a benefit to considering this when there's a choice to make about how to speak to Brazilian consumers about EPA/DHA,” Gearheart said.

GOED was currently “reaching out” to Latin American CODEX delegates in a bid to educate policymakers about the public health benefits and supporting science associated with EPA and DHA intake, he said.